Netwrix helps you comply with PCI-DSS

PCI DSS Benefits

The Payment Card Industry Data Security Standard (PCI DSS) was developed to encourage and enhance cardholder data security and facilitate the global adoption of consistent data security measures. It consists of 12 sections of technical and operational requirements and over 200 controls focused on the security of credit card data.

PCI DSS is mandated by the card brands and administered by the Payment Card Industry Security Standards Council. It applies to all entities involved in payment card processing, including merchants, processors, acquirers, issuers, and service providers. It also applies to all other entities that store, process, or transmit account data, which includes both cardholder data (CHD) and sensitive authentication data (SAD). Failure to comply with PCI DSS can result in fines, loss of reputation, and inability to accept major credit cards.

How does Netwrix help you comply?

As one of the leading cybersecurity solution vendors and providers, Netwrix aims to enable organizations with all the necessary tools to govern, identify, detect, protect, respond, and recover from data breaches be it caused by user, data, or infrastructure-related security gaps.

Our solutions aim to aid security professionals in their Risk Assessment, Threat Identification, and Incident Management efforts by minimizing the cybersecurity impacts, identifying their nature, narrowing their scope, pinpointing their exact timing, and protecting the organization’s most valued assets.

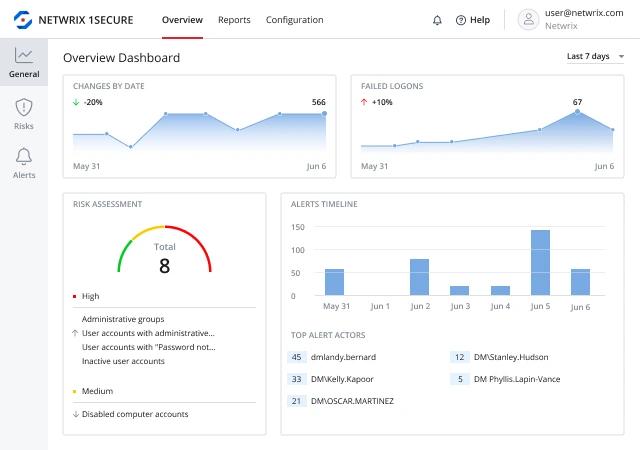

Netwrix 1Secure

Netwrix 1Secure is a SaaS solution that provides visibility into on-premises and cloud environments. It collects data across your IT infrastructure and alerts you to changes such as account modifications, group membership updates, and organizational changes.

Netwrix 1Secure and PCI DSS

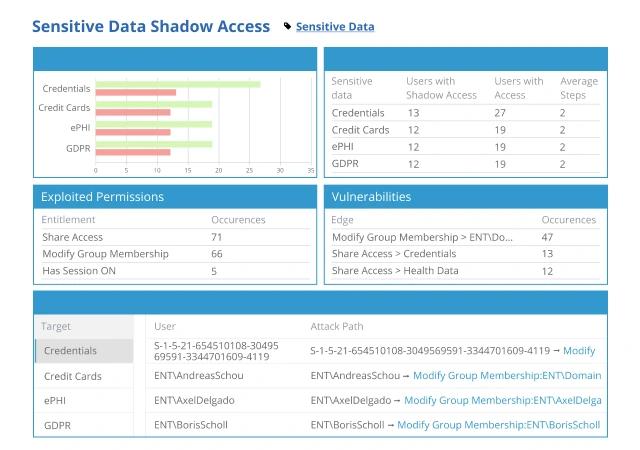

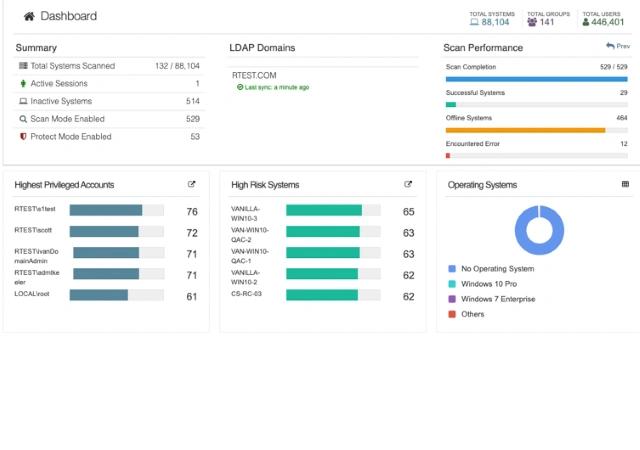

Netwrix Access Analyzer

Netwrix Access Analyzer automates data collection and analysis across over 40 modules, helping you manage and secure critical IT assets—from operating systems to Office 365—across on-premises and cloud environments.

Netwrix Access Analyzer and PCI DSS

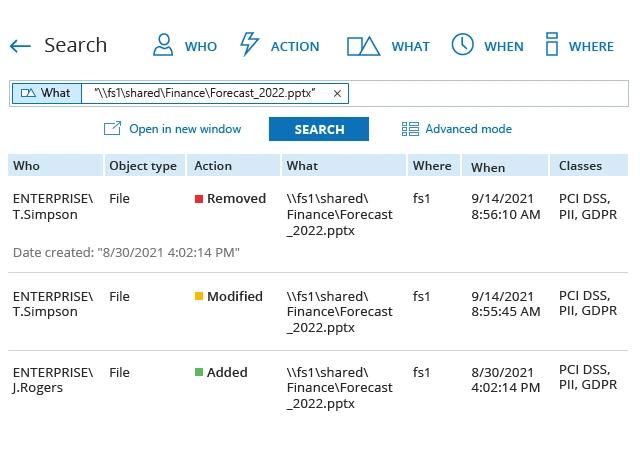

Netwrix Auditor

Netwrix Auditor is a visibility platform that tracks changes, configurations, and access across hybrid IT environments. It delivers security analytics to detect abnormal user behavior and investigate threats before breaches occur.

Netwrix Auditor and PCI DSS

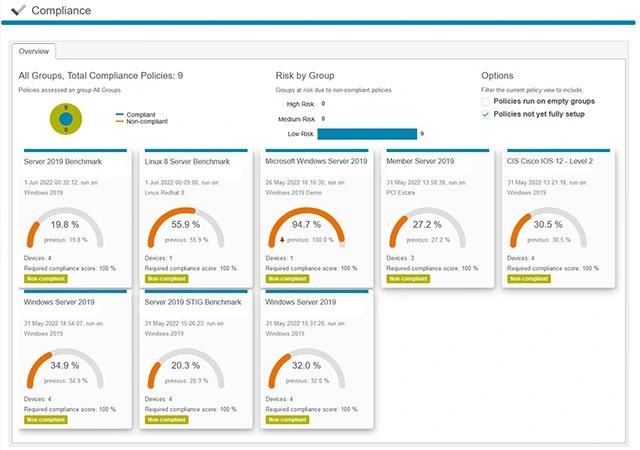

Netwrix Change Tracker

Netwrix Change Tracker is a system configuration and integrity assurance product, used for compliance programs, host intrusion detection, and change control management for enterprise IT systems.

Netwrix Change Tracker and PCI DSS

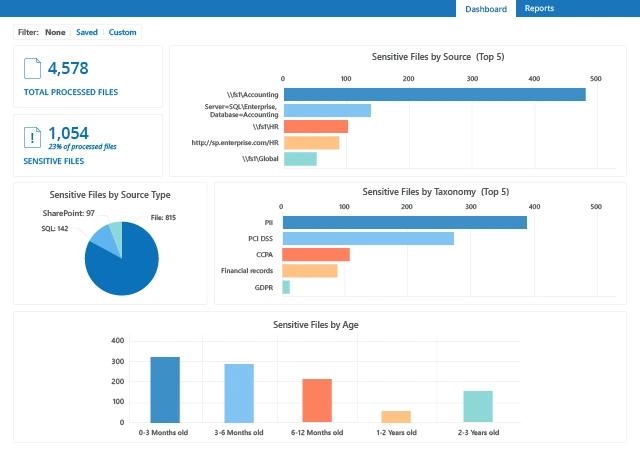

Netwrix Data Classification

Netwrix Data Classification is a data identity platform that enables your organization to reduce risk and unleash the true value of this data.

Netwrix Data Classification and PCI DSS

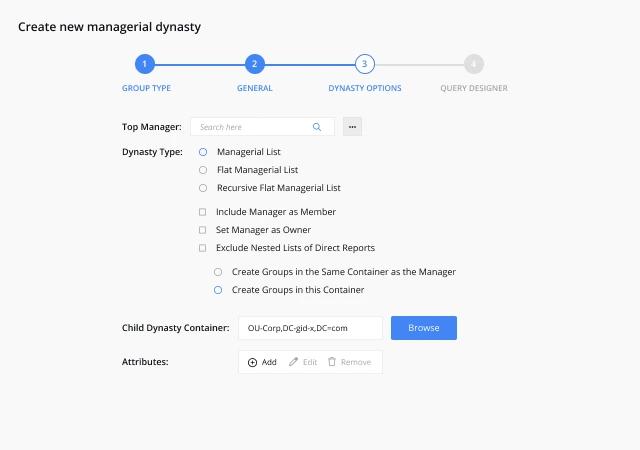

Netwrix Directory Manager

Netwrix Directory Manager simplifies identity and access management by providing automated group, user, and entitlement management capabilities.

Netwrix Directory Manager and PCI DSS

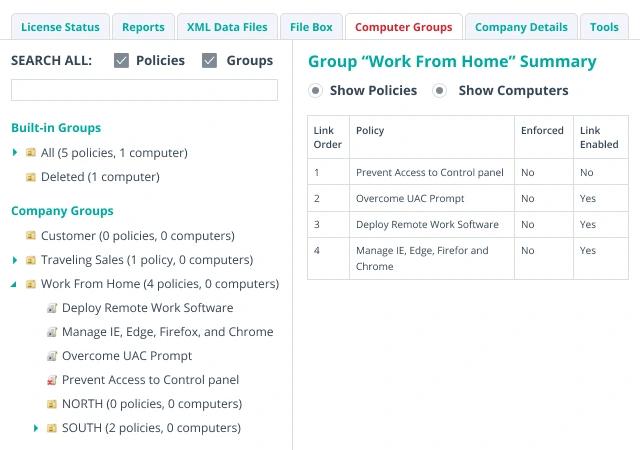

Netwrix Endpoint Policy Manager

Netwrix Endpoint Policy Manager simplifies policy management across diverse endpoints—virtual desktops, thin clients, domain-joined and non-domain-joined devices—ensuring consistent security in hybrid environments.

Netwrix Endpoint Policy Manager and PCI DSS

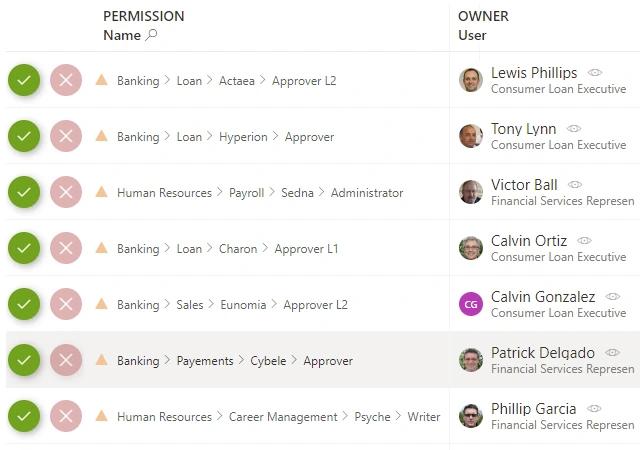

Netwrix Identity Manager

Netwrix Identity Manager is an IGA solution that automates user lifecycle management to enhance security, ensure compliance, and improve productivity for joiners, movers, and leavers.

Netwrix Identity Manager and PCI DSS

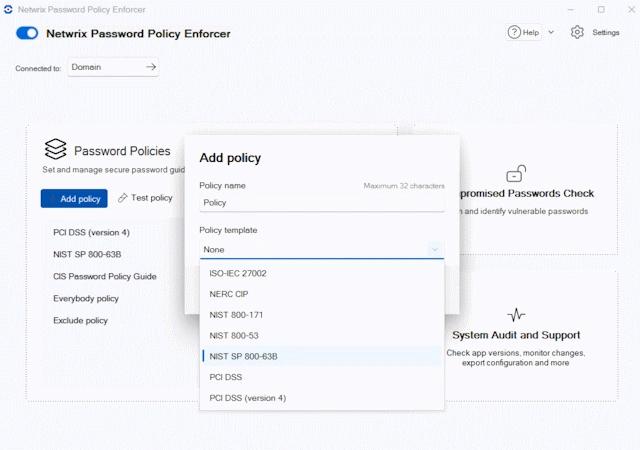

Netwrix Password Policy Enforcer

Netwrix Password Policy Enforcer strengthens security by enforcing strong password policies and providing real-time feedback when users choose non-compliant passwords.

Netwrix Password Policy Enforcer and PCI DSS

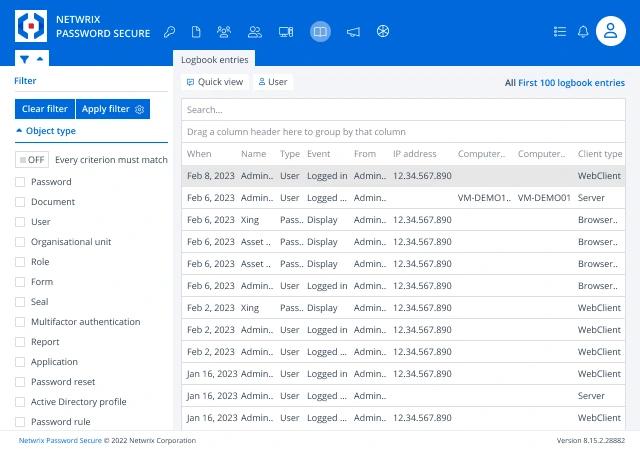

Netwrix Password Secure

Netwrix Password Secure helps enforce strong, compliant password practices by managing credentials, replacing weak passwords, applying role-based policies, auditing usage, and securing privileged access to boost both security and productivity.

Netwrix Password Secure and PCI DSS

Netwrix Privilege Secure

Netwrix Privilege Secure is a next-gen PAM solution that simplifies privileged task management by focusing on actions rather than accounts, reducing complexity and minimizing the attack surface.

Netwrix Privilege Secure and PCI DSS

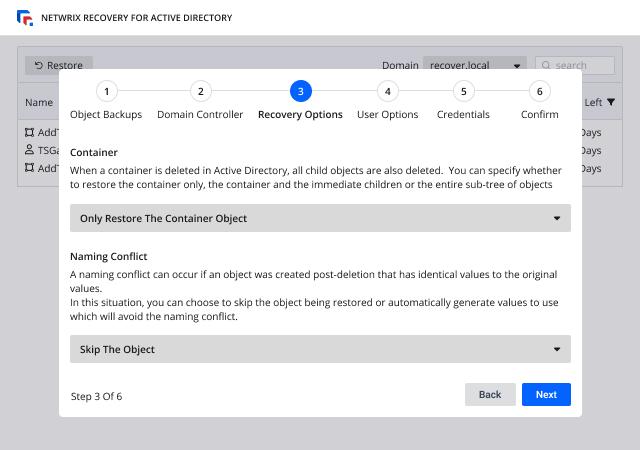

Netwrix Recovery for Active Directory

Netwrix Recovery for Active Directory lets administrators quickly restore objects or attributes to a known good state—minimizing downtime and preventing damage.

Netwrix Recovery for AD and PCI DSS

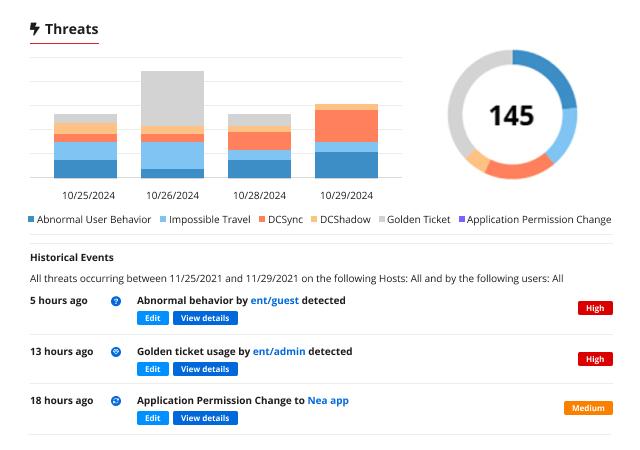

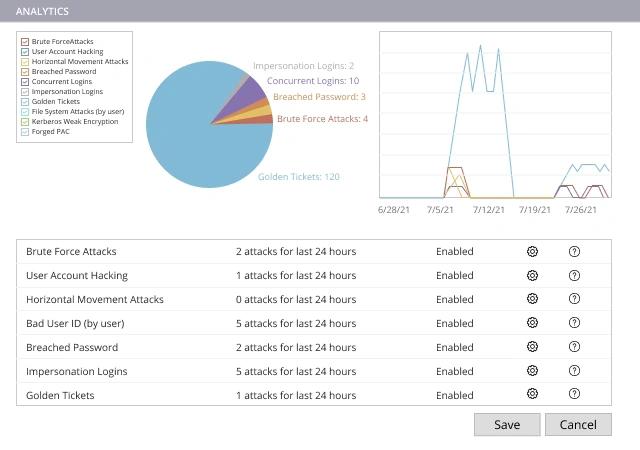

Netwrix Threat Manager

Netwrix Threat Manager detects and responds to advanced threats against Active Directory and file systems with high accuracy. It offers automated, customizable response actions and delivers threat data via tools like Teams, Slack, ServiceNow, and SIEM platforms.

Netwrix Threat Manager and PCI DSS

Netwrix Threat Prevention

Netwrix Threat Prevention protects critical systems like Active Directory, Exchange, and file systems by monitoring user behavior, alerting on suspicious activity, and intercepting threats at the source for added visibility and security.

Netwrix Threat Prevention and PCI DSS

FAQs

Share on

View related compliance concepts

Netwrix helps you comply with Korea’s National Network Security Framework (N2SF)

Netwrix helps you comply with APRA CPS 234

Netwrix helps you comply with the Philippines Data Privacy Act (DPA)

Netwrix helps you comply with India’s Digital Personal Data Protection (DPDP) Act

Netwrix helps you comply with Indonesia’s Personal Data Protection (PDP) Law